Tax Credits for Electric Vehicles

Federal tax credits play a pivotal role in reducing the financial barrier to electric vehicle (EV) ownership. These incentives, sometimes reaching thousands of dollars, help bridge the price gap between EVs and traditional gasoline vehicles. By offsetting a portion of the purchase price, they make sustainable transportation more accessible to budget-conscious consumers. Prospective buyers should note that these credits can make the difference between affording an EV or sticking with conventional options.

Current regulations require buyers to verify their eligibility, as credit amounts vary based on vehicle specifications and battery capacity. Consulting IRS guidelines or a tax professional ensures accurate calculations and compliance with evolving policies.

Rebates and Grants for EV Charging Infrastructure

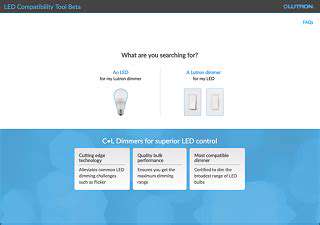

Beyond vehicle purchases, federal programs support the backbone of EV adoption - charging networks. Homeowners and businesses can access funding to install Level 2 chargers, while municipalities receive grants for public charging stations. This dual approach creates a charging ecosystem that addresses both private and public needs, essential for eliminating range anxiety among potential EV adopters.

The Biden administration's recent infrastructure bill has significantly expanded these programs, with particular focus on underserved communities and highway corridors. These strategic investments aim to create a truly nationwide charging network by 2030.

State and Local Incentives: A Complementary Approach

While federal programs provide baseline support, regional incentives often deliver the final push needed for consumer adoption. Some states offer direct cash rebates at point of sale, while others provide reduced registration fees or HOV lane access. California's Clean Vehicle Rebate Project, for instance, has distributed over $1.5 billion in incentives since 2010.

The most effective state programs combine financial incentives with infrastructure development and public awareness campaigns, creating a comprehensive support system for EV transition.

Incentives for EV Manufacturing and Production

The Inflation Reduction Act introduced game-changing manufacturing incentives, including $10 billion in tax credits for domestic battery production. Automakers like Ford and Tesla have already announced billions in new factory investments to capitalize on these benefits. This domestic focus aims to reduce reliance on foreign supply chains while creating high-quality manufacturing jobs.

Considerations for EV Incentive Programs

While incentives accelerate adoption, their design requires careful balancing. Some critics argue that current programs favor wealthier buyers who can afford new EVs. Means-testing provisions and used-EV incentives are emerging as solutions to improve accessibility across income levels.

The most successful policies combine immediate financial incentives with long-term investments in manufacturing and infrastructure, creating a sustainable EV ecosystem rather than temporary market stimulation.

State-Level Incentives: Tailored Support for EV Adoption

State-Specific Financial Incentives

State incentives vary dramatically, from Colorado's $5,000 tax credit to Georgia's $250 annual EV registration fee. These localized approaches allow states to address unique challenges - whether air quality concerns in California or energy independence goals in Texas. Some states even offer additional perks like free parking or reduced toll rates.

The most strategic buyers combine federal, state, and utility incentives, potentially saving $10,000 or more on qualifying vehicles. However, some programs face funding limitations, making early application crucial.

Regional Variations in Incentive Structures

Coastal states typically lead in EV support, but surprising leaders emerge nationwide. Vermont offers up to $4,000 in rebates despite its rural character, while Texas provides $2,500 for plug-in hybrids. These variations reflect differing policy goals - from emissions reduction to economic development in auto manufacturing regions.

Impact of Incentives on EV Sales and Market Growth

Data clearly shows incentives drive adoption - states with robust programs average 50% higher EV market share. Beyond direct sales, these policies stimulate ancillary benefits like increased charging station profitability and used EV market development. This creates a positive feedback loop where infrastructure growth further reduces range anxiety and boosts consumer confidence.

Maximizing Your Savings: Strategies for Claiming Incentives

Budgeting Basics

Strategic budget planning transforms EV ownership from aspirational to achievable. By calculating total cost of ownership - including fuel savings and maintenance reductions - many find EVs cost less than gas vehicles over 5-7 years. Lease options can provide additional flexibility for those uncertain about long-term commitments.

Smart Timing

Incentive availability often follows legislative cycles. Purchasing at quarter- or year-end may qualify for expiring programs, while new initiatives frequently launch at fiscal year beginnings. Some utilities offer time-of-purchase rebates that require dealer coordination.

Documentation Requirements

Successful incentive claims require meticulous documentation - from purchase agreements to battery certification forms. Many state programs now offer pre-approval processes to confirm eligibility before purchase. Keeping digital copies of all submissions prevents delays in processing.

Future-Proofing Your Investment

With technology evolving rapidly, consider lease terms or purchase agreements that protect residual value. Some manufacturers now offer guaranteed buy-back programs, while others provide free software upgrades to maintain vehicle competitiveness.